Solving Healthcare’s Biggest Headwind

The New Era of Workforce Solutions for U.S. Healthcare’s Real Front Lines

By Chris Nichols, Chief Talent Officer, and Tim Schulte, Partner, Council Capital

Workforce is healthcare’s greatest challenge and its greatest opportunity. U.S. Healthcare’s future will be decided on the front lines: in homes, clinics, and every direct care setting. The game-changer is solving the workforce crisis. Labor makes up more than half the cost base for nearly every provider, from behavioral health to hospice, from home health to the pharmacy counter.

Council Capital believes the next wave of value and impact will be unlocked by building a workforce that’s happier, more productive, and deeply invested in patient outcomes. The three critical subsectors where we see the most urgent need and greatest opportunity based upon our own experience and successes are:

01.

Workforce Logistics

Smart, flexible scheduling, shift management, and labor optimization.

02.

Talent Acquisition & Staffing

Finding, engaging, and keeping the people who power healthcare.

03.

Credentialing & Training

Speeding up how fast new talent gets to the bedside and ensuring everyone is prepared, compliant, and growing.

Why does this matter?

Every day a patient waits for a home health nurse, every week lost to credentialing, every hour a therapist spends on paperwork, these delays aren’t just costly. They impact care, trust, and the very fabric of communities. Workforce solutions do more than cut costs; they drive outcomes, create jobs, and build stronger organizations.

1. Introduction

Did You Know?

- More than one in four home health agencies turned away patients last year because they lacked available staff.

- In behavioral health, 37% of U.S. counties have no practicing psychiatrist. Over 150 million Americans currently live in areas with severe mental health provider shortages.

- Annual turnover exceeds 90% among direct care workers.

- Every day a nurse role sits vacant, hospitals lose between $6,000 and $7,500 in potential revenue.

- In hospice care, delays in credentialing prevent hundreds of patients each day from receiving timely, end-of-life support.

The workforce challenge isn’t confined to hospitals. It’s disrupting every corner of the system including home health, therapy, pharmacy, long-term care, dental, and non-emergency medical transport. Burnout, backlogs, and broken workflows are widespread. But with the right tools, this is fixable.

2.1 Workforce Logistics

The Problem

- Manual and fragmented scheduling creates chaos, wastes administrative hours, and reduces staff morale.

- Overstaffing and understaffing contribute to avoidable costs, unnecessary agency spend and increased clinical errors.

- Burnout from rigid schedules is rising, employees with no scheduling control are twice as likely to leave within a year.

By the Numbers

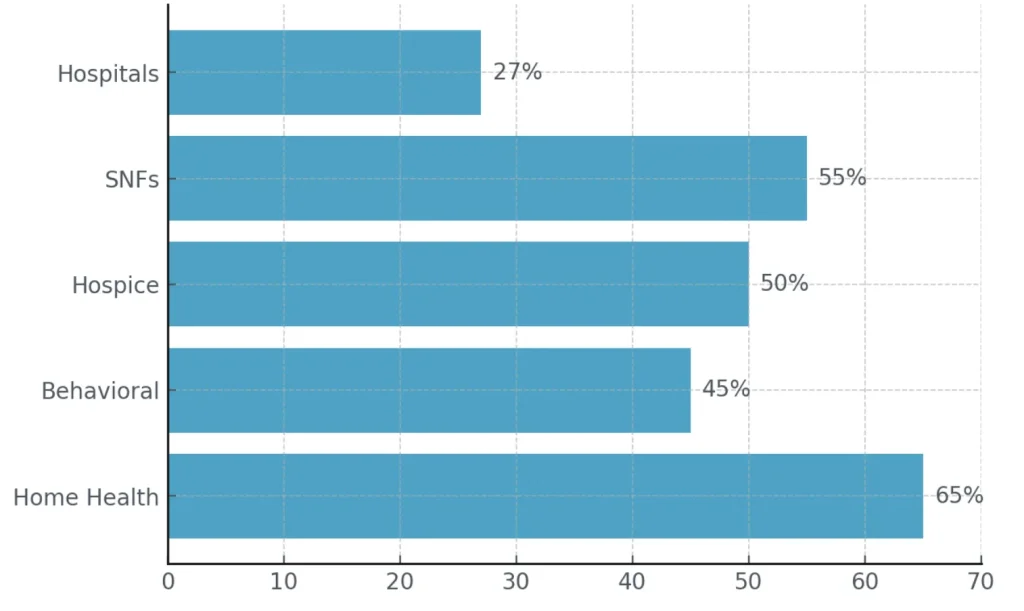

Turnover rates in healthcare’s front lines remain staggeringly high, putting pressure on every aspect of operations and care delivery.

Turnover Rate by Healthcare Sector (%)

Sources: AONL (2023); PHI National (2024); SAMHSA / Mental Health America (2023); LeadingAge (2023)

The Opportunity

- Real-time, data-driven scheduling with mobile access unlocks flexibility and matches staff to demand, improving morale and margin.

- Automated labor forecasting and smart float pools help providers cut costly overtime and reduce agency dependence, a $1.5B+ opportunity in home health alone.

Council Capital in Action: Pediatric Home Health

Challenge:

A leading pediatric home health provider struggled with inefficiency, hiring nurses without aligning them to specific patient cases. This mismatch wasted recruitment resources and limited growth.

Solution:

Council Capital’s value creation team has developed advanced reporting to give recruiters a 30-day preview of future staffing needs. This enabled hiring to be tightly targeted to cases with the highest urgency and better matched nurse skills to client requirements.

Outcome:

By hiring directly to shifts and specific needs, the provider saw billed hours climb from 42,000 in June 2024 to 57,000 hours just 12 months later 36% increase in patient capacity and revenue.

2.2 Talent Acquisition & Staffing

The Problem

- Open jobs mean closed beds, lost revenue, and longer wait times for families

- U.S. health systems will face a 1.2 million shortfall of nurses and direct care staff by 2030, especially in home health, behavioral, SNF, and outpatient.

- Clinical openings can take 90+ days to fill; behavioral health roles average 120–180 days.

By the Numbers

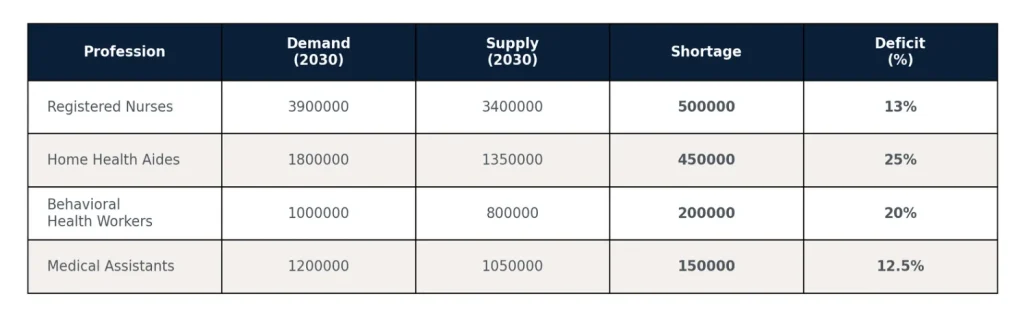

Turnover rates in healthcare’s front lines remain staggeringly high, putting pressure on every aspect of operations and care delivery.

Projected Workforce Shortages in 2030

The Opportunity

- Open jobs mean closed beds, lost revenue, and longer wait times for families

- U.S. health systems will face a 1.2 million shortfall of nurses and direct care staff by 2030, especially in home health, behavioral, SNF, and outpatient.

- Clinical openings can take 90+ days to fill; behavioral health roles average 120–180 days.

Council Capital in Action: ABA Provider

“A leading ABA provider cut talent costs by 17% and nearly tripled workforce coverage after Council Capital’s value creation team overhauled recruiting.”

Challenge:

A leading ABA therapy provider was experiencing stalled growth due to high turnover among technicians and an inability to recruit at the scale required to meet rising demand.

Solution:

Council Capital’s value creation team implemented a three-phase approach:

01.

Streamlined and optimized talent acquisition workflows, improving cross-team collaboration.

02.

Recruited and onboarded a data-driven TA manager to lead the team.

03.

Piloted and rolled out a fully outsourced recruiting model, balancing cost efficiency with effectiveness.

Outcome:

By hiring directly to shifts and specific needs, the provider saw billed hours climb from 42,000 in June 2024 to 57,000 hours just 12 months later 36% increase in patient capacity and revenue.

2.3 Credentialing & Training

The Problem

- Credentialing delays in ancillary care average 60–120 days, costing millions in unbilled revenue and delaying patient access.

- Compliance is a labyrinth; a single missing form can delay service by weeks.

- Training is still manual, and e-learning is rare, and staff often feel unprepared

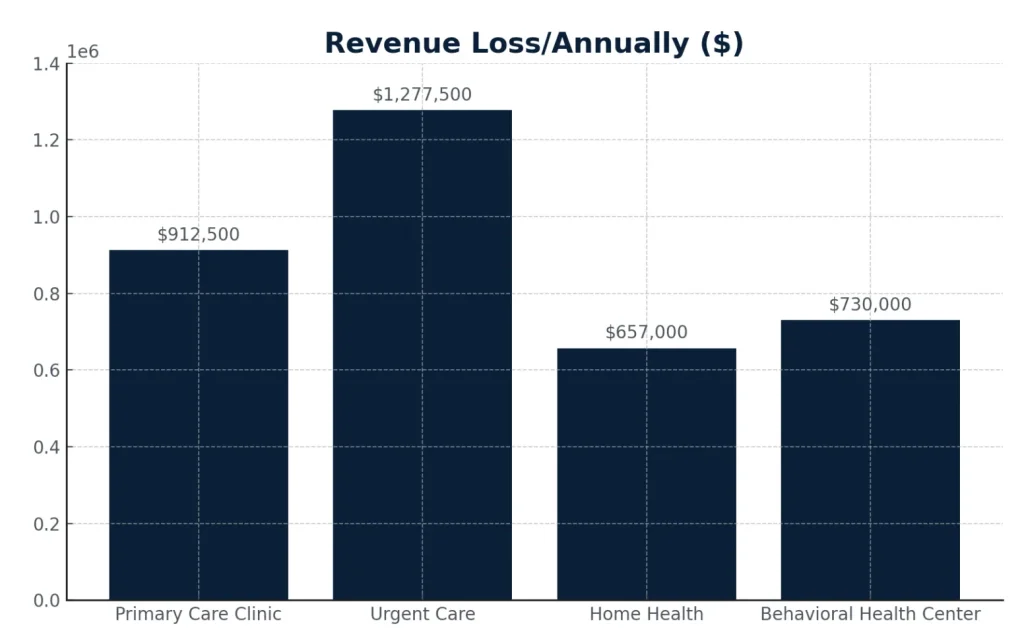

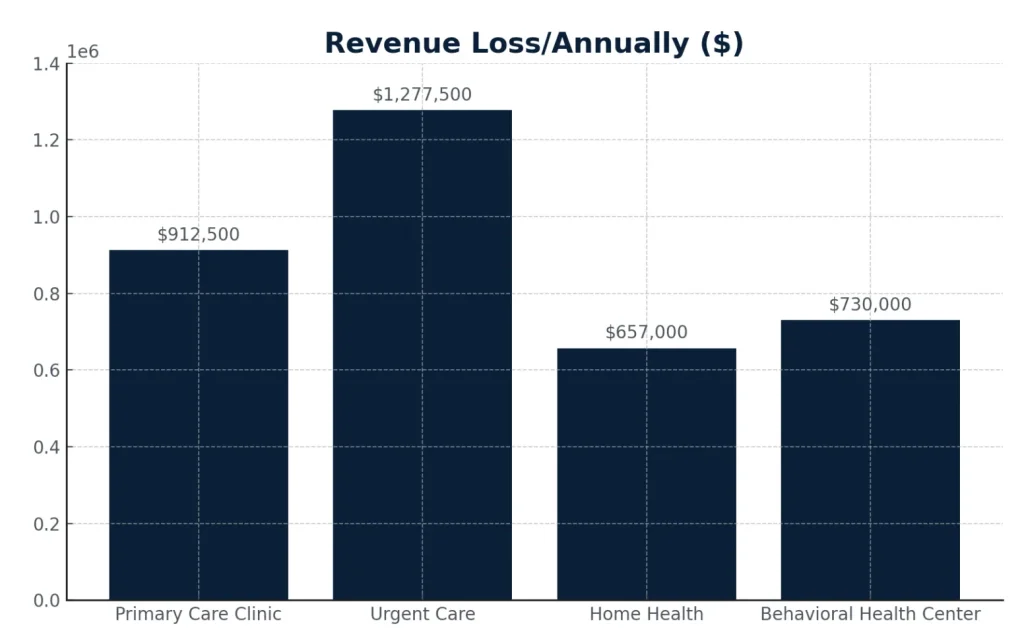

By the Numbers

Credentialing delays don’t just slow onboarding, they cost providers millions in lost revenue and keep patients waiting

Sources: AONL (2023); PHI National (2024); SAMHSA / Mental Health America (2023); LeadingAge (2023)

The Opportunity

- Credentialing-as-a-service and integrated LMS platforms are a $1.9B addressable market in 2025, driven by digital healthcare and staffing shortages.

- Agencies using digital credentialing solutions report 50%+ reduction in onboarding time, yielding immediate revenue gains and faster patient starts.

Council Capital in Action: Home Health Care Provider

“This home health care provider reduced onboarding-to-care timelines by 43% and improved client satisfaction by overhauling its caregiver orientation model.”

Challenge:

This leading provider of home health care provider faced inefficiencies in caregiver onboarding that delayed time to care and limited caregiver readiness. Orientation began before onboarding was complete, resulting in disengagement, variable attendance, and inconsistent care quality.

Solution:

Council Capital’s value creation team partnered with a pediatric home health care provider to implement a streamlined onboarding strategy:

- Shifted all onboarding requirements to occur prior to orientation, ensuring participants entered as active employees.

- Redesigned the orientation to a three-day model featuring a virtual Day One and in-person clinical skills evaluation.

- Implemented pod alignment to enhance caregiver-to-patient matching and optimize scheduling.

- Increased engagement and accountability through clearer role expectations and readiness at day one.

Outcome:

he average time from Meet & Greet to First Bill dropped from 14 days to 8 days; a 43% improvement in speed to care. Attendance and engagement during orientation improved, and client satisfaction scores rose steadily, particularly in areas tied to caregiver competency and skill alignment.

3. Investment Thesis: Market Sizing and Financial Levers

The U.S. ancillary care market, including home health, behavioral, SNF, and therapy, exceeds $500B in annual spend, with labor consistently accounting for around 60%. Over the next decade, the market is projected to grow by more than $350B, driving labor costs up by over $200B. Even a 1% gain in workforce productivity or retention will generate at least $5B in incremental margin by 2033. Council Capital estimates that scalable workforce solutions can unlock $10B+ in annual value, making this one of the most compelling investment opportunities in healthcare today.

By the Numbers

With labor accounting for 60% of ancillary care’s $500B+ annual market, every small productivity gain adds up to billions in value creation.

This chart highlights the decade-long expansion in both total market size and labor spend, emphasizing the extraordinary value available to innovators who deliver real workforce improvement.

What’s Next: Council Capital’s Blueprint for Impact

- The status quo is not an option. Council Capital invests in solutions that create measurably better patient outcomes by putting the workforce first.

- The most impactful companies will be those who modernize logistics, make hiring/training a strategic weapon, and deliver happier, higher-performing care teams

- Our partners have seen this from both sides: outside as RPOs, inside as operators and value creators. We’re ready to lead the next era.

To learn more about Council Capital or discuss this white paper, please contact:

Partner, tschulte@councilcapital.com

Chief Talent Officer, cnichols@councilcapital.com

Director, dpierce@councilcapital.com